Running a small business in the Philippines—especially for MSMEs—is often romanticized. We talk about being our own boss, following our passion, turning dreams into family legacies. But for many MSMEs in the Philippines, the daily reality is far more difficult—and far quieter.

As of 2024, MSMEs account for 99.6% of all registered businesses in the country and employ over 65% of the national workforce. These aren’t fringe players—they are the backbone of the economy. And yet, they’re expected to carry policy burdens without the benefit of structural support.

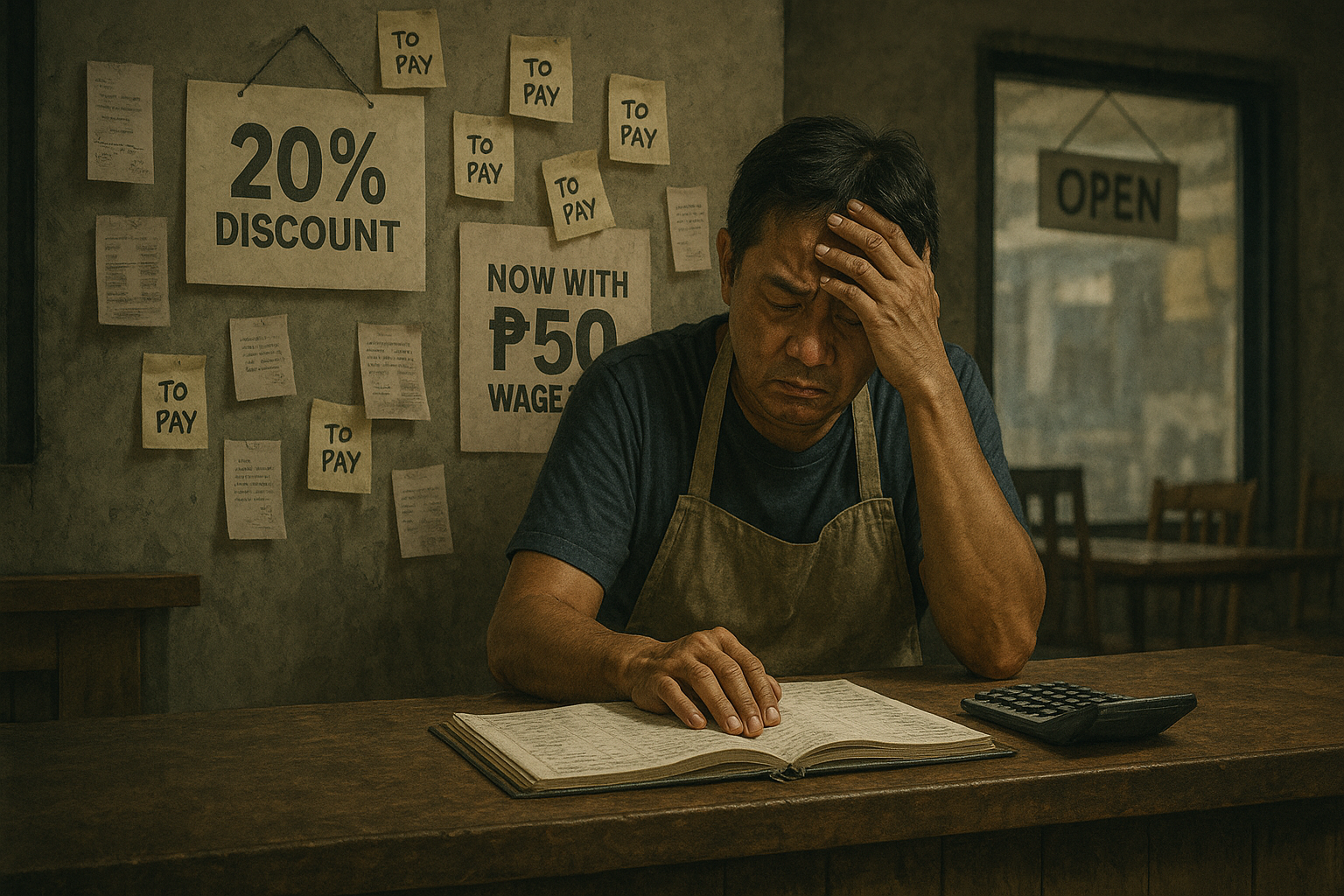

Margins are thin. Overheads keep rising. And with every new mandate, it feels like the walls are closing in.

Now, a new bill—House Bill No. 16, filed by Speaker Martin Romualdez—proposes that senior citizens and persons with disabilities (PWDs) should receive their mandatory 20% discount and 12% VAT exemption on top of existing promotional offers. It’s a policy that sounds generous on the surface. But for many small entrepreneurs, it’s yet another burden they may not survive.

What the Bill Actually Says

Today, under Republic Acts 9994 and 10754, seniors and PWDs are entitled to discounts and VAT exemptions on essential goods and services. Most small businesses already honor these—without reimbursement from the government.

But the Department of Trade and Industry (DTI) currently allows discounted promo items to be exempt from additional discounts. That exemption gives MSMEs a bit of breathing room—especially when running markdowns to stay competitive.

The Romualdez bill would remove that cushion. If passed, MSMEs would be required to apply the full 20% discount on top of any promo pricing—so long as the final price doesn’t fall below “production cost.”

(Though how “production cost” will be defined and enforced remains unclear.)

In practice? For many small operations, that could mean selling at a loss.

It’s Not Just the Discounts

Just before the bill was filed, the Metro Manila wage board approved a ₱50 daily wage increase, bringing the minimum daily rate to ₱695.

It’s a necessary move to help workers. But for MSMEs, especially in food and services, it adds ₱15,000–₱25,000 to monthly payroll—with no support or relief to balance it out.

Layer that with supply price hikes, rent, and now deeper discount mandates, and the pressure compounds.

A System That’s Easy to Abuse

There’s another issue many businesses face: fake or misused PWD IDs.

From cafes and drugstores to public transport, MSMEs regularly encounter abuse of the system—yet have few tools to verify IDs or enforce rules. Most comply quietly, afraid of getting penalized for questioning it.

Before expanding benefits, shouldn’t we fix the loopholes in the system first? Without checks and balances, small businesses bear the brunt of others’ dishonesty.

What It Feels Like on the Ground

Many small businesses today are quietly struggling. One businessman shared that he’s barely turning a profit—and he’s far from alone.

But most hesitate to speak up. There’s a fear that admitting difficulty might scare away customers or damage the brand. In a culture that celebrates hustle and resilience, it’s hard to say, “I’m not okay.”

Still, if we want policies that reflect reality, we need to normalize talking about the pressure. Because silence won’t protect what we’ve built.

“If MSMEs are expected to uphold public good, then public policy should also uphold MSMEs.”

What MSMEs in the Philippines Really Need

This isn’t about rejecting support for the elderly or the vulnerable. Most of us care for aging parents or differently-abled loved ones. We understand what these benefits mean.

What MSMEs are asking for is balance.

That means:

-

A seat at the table before new mandates are passed

-

Partial reimbursement or tax relief for mandatory discounts

-

Enforcement against fraudulent ID use

-

Timelines that reflect real operational capacity

Other leaders in the food and hospitality industry are calling for more thoughtful economic trade-offs.

Chef Kalel Chan, a respected figure in the F&B sector, underscores the stakes:

“The proposed wage bill could have severe consequences for businesses, potentially leading to reduced work hours, job losses, and even business closures. Sana to fix these negative impacts, a reduction in the 12% VAT should be implemented—for the benefit of both businesses and their employees.”

It’s a reminder that policy doesn’t exist in a vacuum. Every well-intentioned reform must consider its ripple effect—not just on labor, but on the sustainability of the businesses that employ them.

If small businesses are to continue creating jobs and serving communities, they need policy that supports them, not sidelines them.

It’s a question many are asking quietly—but more of us should be asking out loud.

The Question We All Need to Ask: Kaya pa ba?

Chef Waya Arias-Wijangco recently said it best:

“Establishments already shoulder the 20% senior and PWD discounts without any reimbursement from the government. Now, under the Romualdez bill, they’ll be required to apply those on top of existing promo prices—while also absorbing the recent ₱50 wage hike. Kaya pa ba ng maliliit na negosyo?”

It’s the question many MSMEs are whispering—but more of us need to ask aloud.

Because if this pattern continues—without reform, relief, or representation—we won’t just lose profits. We’ll lose the soul of our neighborhoods.

The carinderia that knew your order. The barbershop your dad went to. The café that felt like home.

If we want them to stay, we need policies that see them. Support them. And give them room to breathe.

As David Sison, President of Resto.PH, puts it:

David Sison, President of Resto.PH, believes the solution should work for all:

“We support the spirit of the bill. Seniors and PWDs deserve care. But asking small restaurants to apply promo discounts and mandatory 20% discounts—without government subsidy—is unsustainable. What many don’t see is that these costs are fully absorbed by businesses already stretched thin.”

“Before adding new mandates, let’s first fix the abuse of fake PWD IDs. That alone drains the system. And most importantly, let’s talk. Resto.PH has not been consulted, and we’re calling for proper dialogue. Policies must protect the vulnerable, yes—but they also need to respect the realities of running a small business.”

It’s a call that echoes across the sector—from chefs to entrepreneurs to industry advocates.

Because support doesn’t have to be a zero-sum game. We can protect the vulnerable and the businesses that serve them. But it begins with listening—to the ground, to those shouldering the cost, and to those who still believe there’s a better way.

Because if this continues unchecked, we may not just lose profits—we may lose the small businesses that give our neighborhoods their soul.

Read More on Simpol

What the ₱200 Wage Hike Means for Small Businesses in the Philippines

How small businesses are navigating rising labor costs and survival trade-offs in a post-pandemic economy.